Welcome

California families are getting hammered at the pump like never before, and the progressive Democrats in Sacramento aren’t sorry—they’re proud of it. While the rest of America watches gas prices dip...

When Even Loyal Conservatives Say “Enough.” There is nobody smarter in Hollywood than actor James Woods, and when this lifelong conservative throws up his hands and walks away from the Republican...

The 2026 Midterms Aren’t Waiting For Patience Eight months. That’s all the time Donald Trump and the Republican Party have before the midterm elections, and the clock is ticking mercilessly. History...

If you’ve been paying attention, really paying attention, and it’s obvious by now that James Talarico is staging one of the most shameless political identity makeovers in recent memory. After years of...

A Sudden Case Of Political Amnesia. Every election cycle brings a remarkable transformation in American politics, but few are as dramatic as the one currently unfolding inside the Democratic Party...

Gavin Newsom is preparing to walk a political tightrope unlike any he’s faced before. As he eyes a national stage, Newsom is attempting the nearly impossible: appealing simultaneously to the radical...

As the United States edges deeper into conflict with Iran, a glaring political question hangs in the air: Where exactly is Vice President J.D. Vance? For years, Vance built his political identity on...

Something smells rotten in California politics, and it isn’t subtle anymore. Behind the scenes, insiders tied to the California Democratic Party appear to be carefully arranging the chessboard for the...

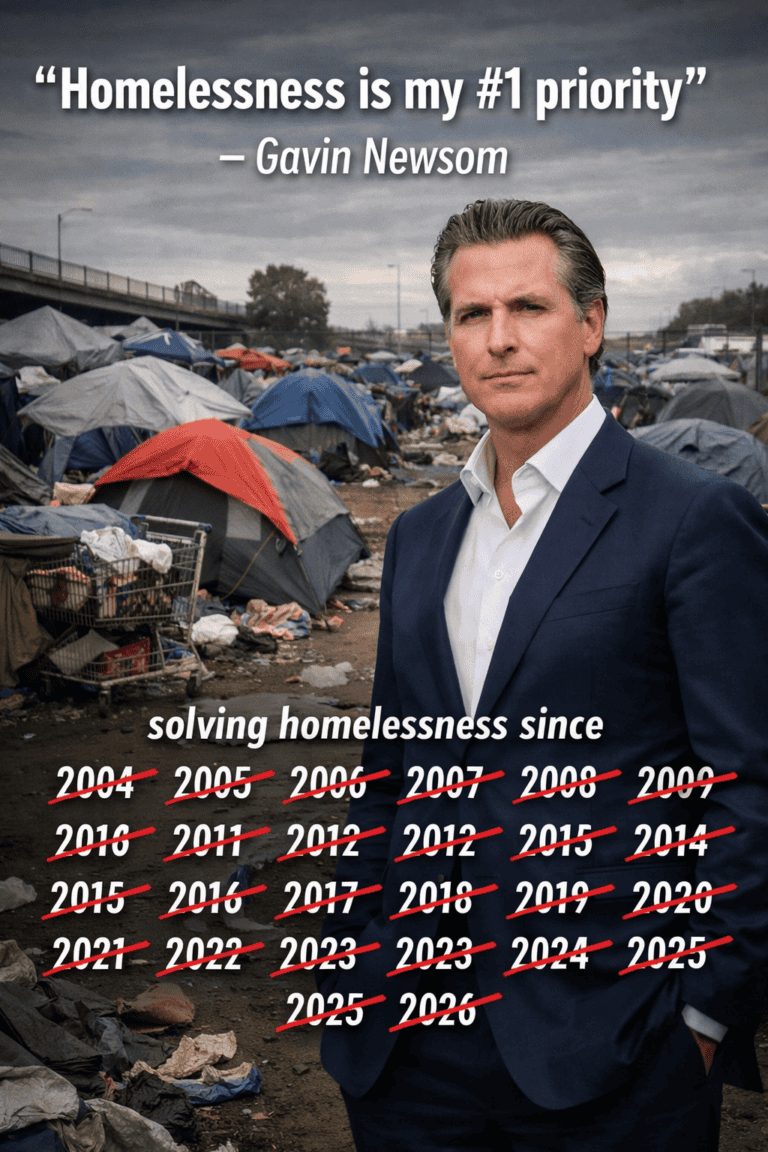

The California Experiment That Became A National Warning. For more than twenty years, Gavin Newsom has promised to solve homelessness. He made the pledge as mayor of San Francisco. He repeated it as...